Digital nomads, always on the move, seek seamless solutions to simplify their lifestyles. The advent of digital wallets like Google Pay and Apple Pay offers a convenient way for nomads to navigate transactions without the burden of physical wallets. In this comparison, we delve into the technical intricacies and security features of both platforms, aiding digital nomads in making informed choices for a wallet-free existence.

How Does Apple vs Google Pay Work?

Digital nomads, relying on technology for every aspect of their lives, are increasingly drawn to mobile payment solutions. Google Pay and Apple Pay, the frontrunners in this realm, employ payment tokenization to shield sensitive credit card information during transactions. Apple Pay, a pioneer since 2013, secured its position by perfecting this technology, emphasizing user-friendly and secure transactions. Google Pay, introduced in 2018, shares a similar approach but stands out in how it manages payment token storage and transmission, especially considering the potential involvement of Google’s servers. As digital nomads crave efficiency, understanding the technical details becomes paramount for choosing the right wallet-free companion.

The Concept of Tokenization

For digital nomads constantly navigating various landscapes, the concept of tokenization in mobile payments becomes crucial. Both Apple Pay and Google Pay leverage this technology to replace the primary account number (PAN) of a credit card with a secure token. Apple Pay’s 2013 introduction made it a trailblazer in this space, fostering collaboration with payment networks and large issuing banks. In contrast, Google Pay, since 2018, embraces tokenization but introduces confusion with its branding. While both platforms collect credit card information on the device, the nuanced differences lie in how they handle, store, and transmit payment tokens. Understanding these intricacies empowers digital nomads to opt for the solution aligning with their nomadic lifestyle.

Historical Evolution of Mobile Payments

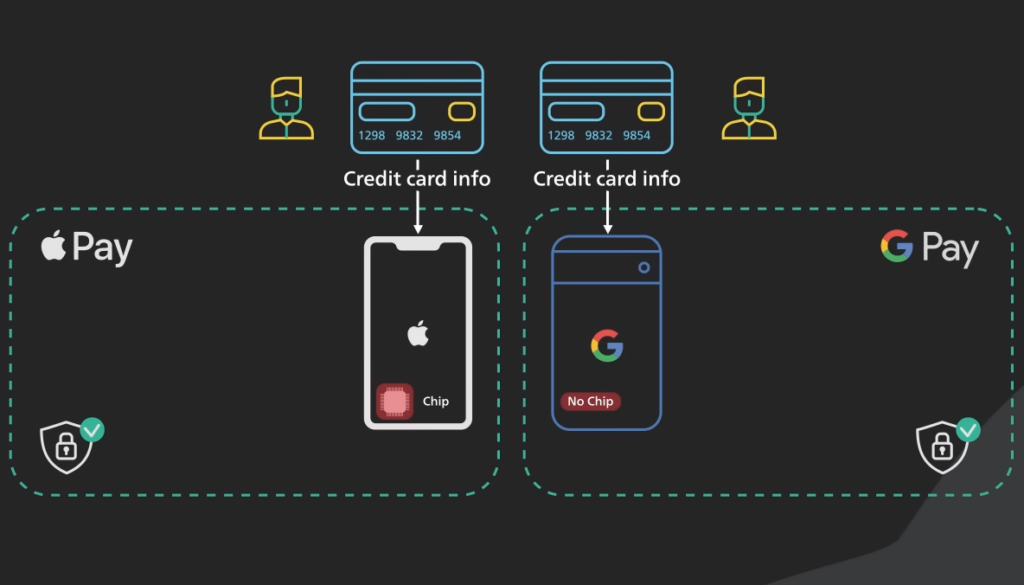

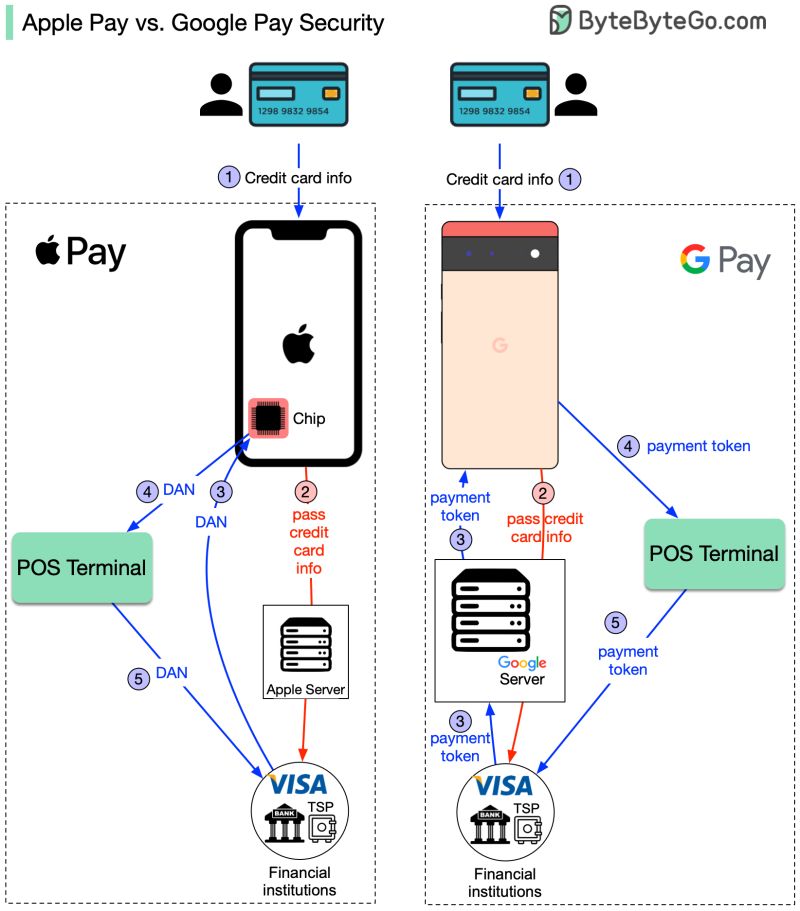

Apple Pay and Google Pay use payment tokenization, but their implementations diverge. Apple Pay’s secure element storage and offloading token generation to a TSP exemplify its commitment to security. On the other hand, Google Pay, using host card emulation (HCE), stores tokens in the wallet app, potentially on its servers. The transaction process involves near-field communication (NFC) transmission to Point-of-Sale terminals, with Apple Pay retrieving tokens directly from the secure element and Google Pay using HCE.

Technical Details of Apple Pay

Token Generation and Storage

Apple Pay’s tokenization prioritizes security by collecting credit card information on the device and transmitting it to Apple’s server for token generation. The token is stored in a secure element, enhancing user security. The tokenization process involves cooperation with a token service provider (TSP), ensuring that sensitive information remains secure throughout the transaction process.

Transaction Process with Apple Pay

When a purchase is made, Apple Pay retrieves the token from the secure element and transmits it to the merchant’s Point-of-Sale terminal via NFC. The token’s secure journey ensures that the credit card information is never stored on Apple’s servers. The payment network validates the token, and the TSP detokenizes it for authorization, offering a seamless and secure transaction experience.

Technical Details of Google Pay

Token Generation and Storage Differences

While Google Pay also employs payment tokenization, its approach differs. The PAN is sent to Google’s server, and the token, called D-PAN, is stored in the wallet app. Unlike Apple Pay, Google Pay doesn’t claim that payment tokens are never stored on its servers, highlighting a distinction in token storage methods.

Transaction Process with Google Pay

Similar to Apple Pay, Google Pay transmits the payment token over NFC to the Point-of-Sale terminal. The token retrieval process, however, involves the wallet app securely fetching the token from the cloud. Despite these differences, the transaction flow aligns with Apple Pay, with both prioritizing secure and efficient transactions for digital nomads.

Consider exploring the convenience of wireless smart payment rings, providing a hands-free alternative for transactions. Read more about this emerging trend and how it can further enhance the nomadic lifestyle.

Security Aspects

In the ever-evolving landscape of digital nomadism, security is paramount. Both Apple Pay and Google Pay prioritize secure transactions, but their technical details differ slightly. Apple Pay’s introduction brought forth the concept of tokenization, ensuring that credit card information is collected on the device and transmitted securely without being stored on Apple’s servers. On the other hand, Google Pay, with its inception, embraces payment tokenization but adopts a different approach. Credit card information is collected on the device, sent securely to the Google server, and potentially stored on its servers. Despite these differences, both platforms ensure secure NFC transmission of payment tokens to point-of-sale (POS) terminals, offering digital nomads peace of mind in their wallet-free endeavors.

Comparison of Apple Pay and Google Pay

For digital nomads seeking the perfect mobile payment companion, a detailed comparison between Apple Pay and Google Pay becomes crucial. Both platforms prioritize secure payment systems through payment tokenization. Apple Pay’s 2013 inception and secure element storage distinguish it, offering a localized and secure approach to tokenization. In contrast, Google Pay, since 2018, has utilized host card emulation (HCE) and wallet app storage, potentially involving its servers in token storage. The payment process, involving token retrieval and NFC transmission to POS terminals, aligns with slight variations. For digital nomads, the choice between the two systems depends on individual preferences, device compatibility, and nuanced differences in implementation.

Concluding Thoughts

Examining the technical details reveals that both Apple Pay and Google Pay are secure implementations with payment tokenization technology. Apple Pay, with its 2013 inception, perfects tokenization for a user-friendly and secure experience. In contrast, Google Pay’s implementation, introduced in 2018, shares similarities but differs in token storage and potential server involvement. The nuanced differences between the systems offer digital nomads distinct choices for secure and convenient mobile payments. The decision may hinge on individual preferences and device compatibility.